Over the past few weeks I have had the pleasure of experiencing the buzz and excitement of what’s been dubbed, “InsureTech.” I’ve been fortunate to compare notes with executives from top 100 insurance companies, MGA startups, technology vendors and industry consultants. And while at times the buzz feels eerily similar to the late 90’s when everyone was talking about the disintermediation of independent agents and frictionless transactions via websites, this time around it feels different. What’s different today is that seemingly everyone from our industry can agree on two things, change is coming and the pace of change is faster than ever before.

Today, much of the foreseeable change centers around customer engagement strategies. Both start-ups and incumbent insurers see the value in transforming the customer experience and are focused on delighting the end user. Rusty Sproat, CEO and Co-Founder of FIGO Pet Insurance, an Insuresoft customer, describes a holistic approach to the customer experience as a shift from the “value in exchange” to a “value-in-use” strategy. For years insurance has centered on a “value in exchange” model, in which a product or service is offered in exchange for cash. Value-in-use is not based on mere product ownership in exchange for cash, but rather evolves customer trust and loyalty through the usage of various free offerings first. This new trend is exemplified outside of the insurance industry with apps like Venmo®, created by Paypal®, which allows consumers free use of their product as a precursor to later upsell or market another product or service, often with immense success.

FIGO’s Pet Cloud leverages their own value-in-use model, which provides everything pet owners need for their pet’s “well-being.” Through the Pet Cloud pet owners can find pet friendly restaurants, nearby dog parks, as well as connect with other similar breed pet owners who want to meet up. Almost incidental to this experience, pet owners can also buy pet insurance from the Pet Cloud as well as the mobile app. FIGO’s Pet Cloud offers a meaningful example of how the insurance industry can reinvent its business models and growth strategies for the digital world.

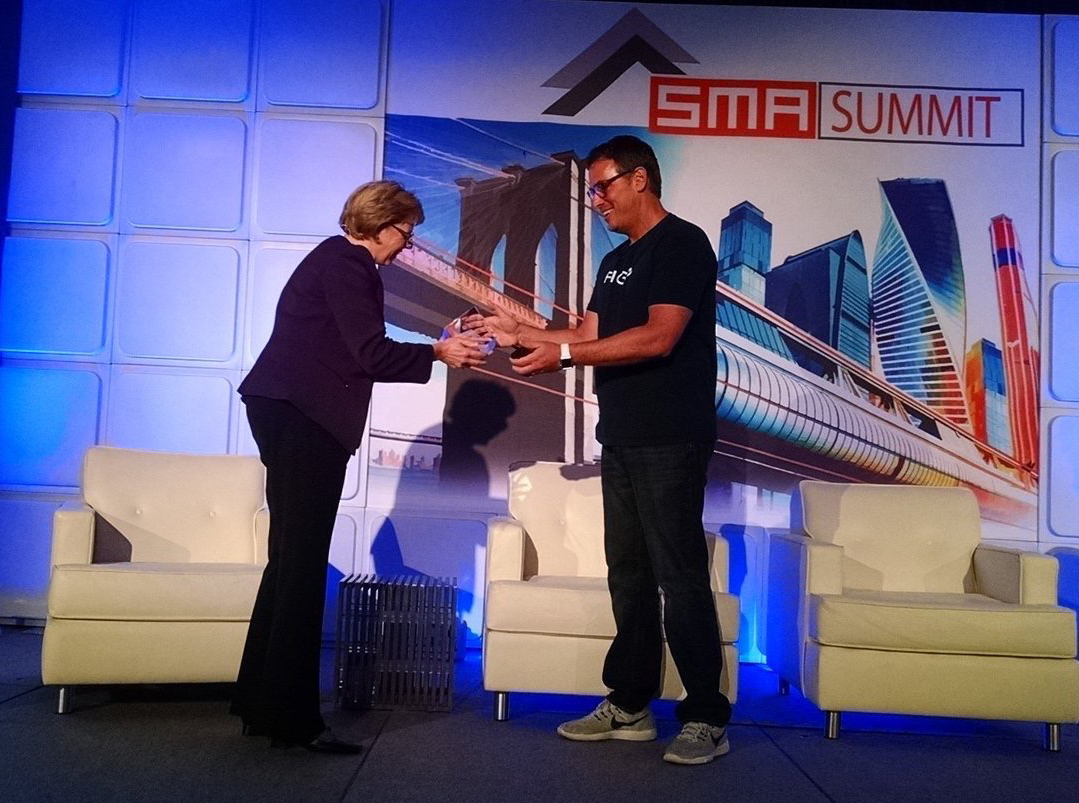

Recently FIGO was recognized as a Next-Gen Insurer and was presented with the much deserved “Innovation in Action” Award by Strategy Meets Action (SMA), a leading insurance strategic advisory firm. For the past five years, the SMA Innovation in Action Awards have been presented to celebrate innovation in the insurance industry. SMA launched this awards program to recognize solutions that enable an insurance company to advance on their “transformational journey toward becoming a Next-Gen Insurer.”

While it’s certainly wonderful for an Insuresoft customer to be recognized as a Next Gen Insurer, the FIGO story represents more than a behavioral economics theory or step towards digital disruption. Here, it’s also about execution speed. The FIGO story is an example of how it is possible for insurers with online distribution models to launch in all 50 states in less than 12 months on a cloud-based policy, billing, and claims platform. By leveraging Insuresoft’s core policy administration system and strategic partners, FIGO was able to develop, test, and implement their first state within 90 days. From there, the remaining 51 states and jurisdictions were rolled out in less than 12 months.

Insurers who are looking to emulate FIGO’s value-in-use digital insurance distribution model can trust that there is a partner, like Insuresoft, who can help to enable these new sales channels. Whether insurers are looking to create a non-traditional auto line of business, provide renters insurance, or another line of business for the “shared economy”, they will need to select a partner who can easily integrate with other systems.

For startup insurers or those looking to transform their current business model, know that FIGO’s strategy isn’t a hypothetical or idealistic approach to the industry. FIGO won SMA’s “Innovation in Action” award because they embraced the value-in-use business model and because they chose a “partner in innovation” that was able to execute at the appropriate pace. Next-Gen insurer’s like FIGO are demonstrating that, with the right partner, it is a truly great time to be in the business of delivering insurance.